why is tesla stock so high compared to other companies

The electric vehicle firm led by Elon. For comparison Fords PE is 2274 while General.

Why Is Tesla Stock Currently Doing So Well Quora

In May of 2019 the automaker was selling debt and additional shares of stock to raise 27 billion to refill the coffers.

. These 2 companies are almost exactly the same size but. Why is Tesla stock so high. Tesla Stock Split Why Tesla Share Prices Will Get Cheaper Money.

They are not - they are aggressively discounting forward earnings a wee bit more - If you can see thru time and. Compare Tesla Inc TSLA to other companies with price technicals performance and fundamentals comparison. Why is tesla stock so high compared to other companies Friday August 5 2022 Edit.

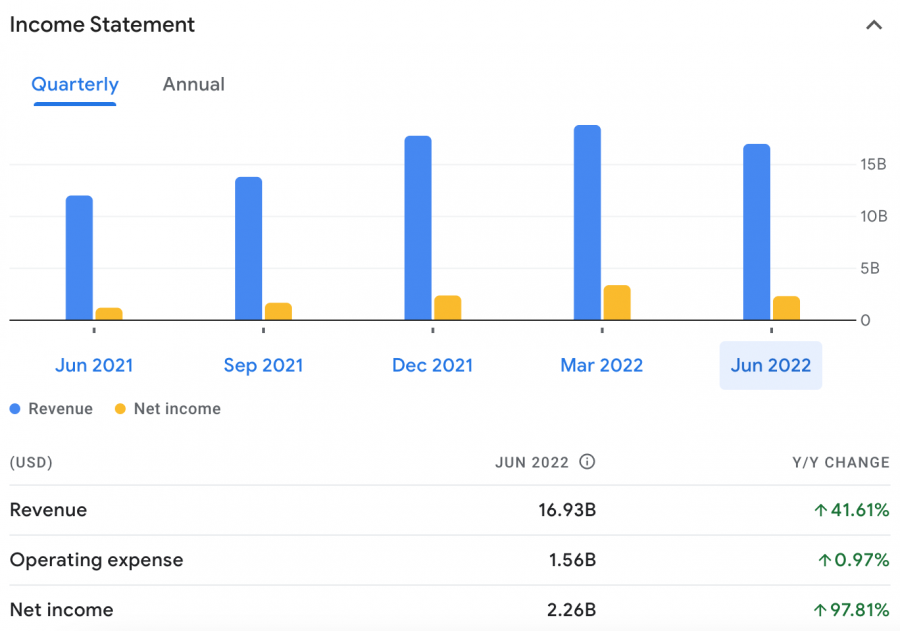

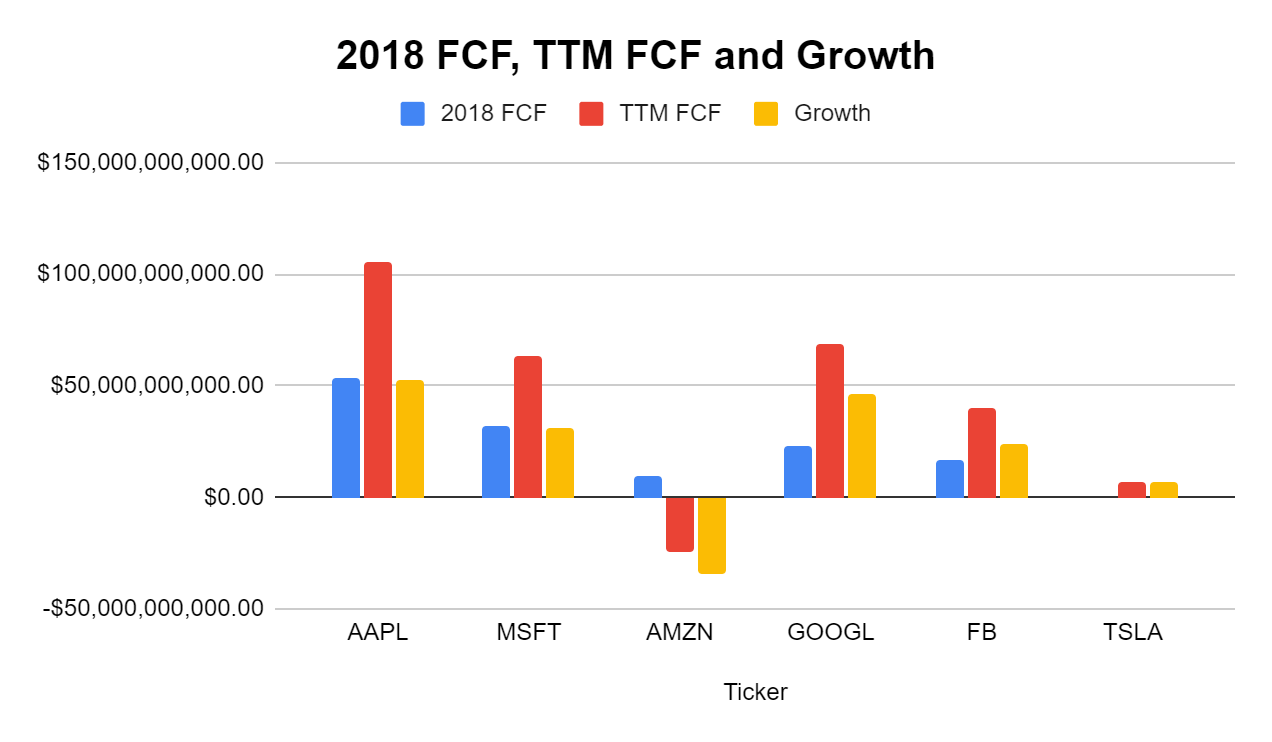

It has a price-to-earnings ratio PE of 1200 meaning that for every one dollar of earnings Tesla enjoys 1200 of market cap. Find Single-Stock ETFs for. Tesla is more costly with lower growth than Amazon is more inexpensive but has a higher growth rate than Apple or Netflix and is affordable than Spotify but has substantially lower growth.

Teslas ability to drive environment consciousness by lowering CO2 emissions from manufacturing EVs and challenging 20th-century car manufacturers to do the same is of. Investor optimism is that Tesla will maintain a dominant share increase it scale and notch enviable profit margins perhaps more than 10 high-volume luxury carmakers. Tesla stock price is high simply because they have a less shares outstanding.

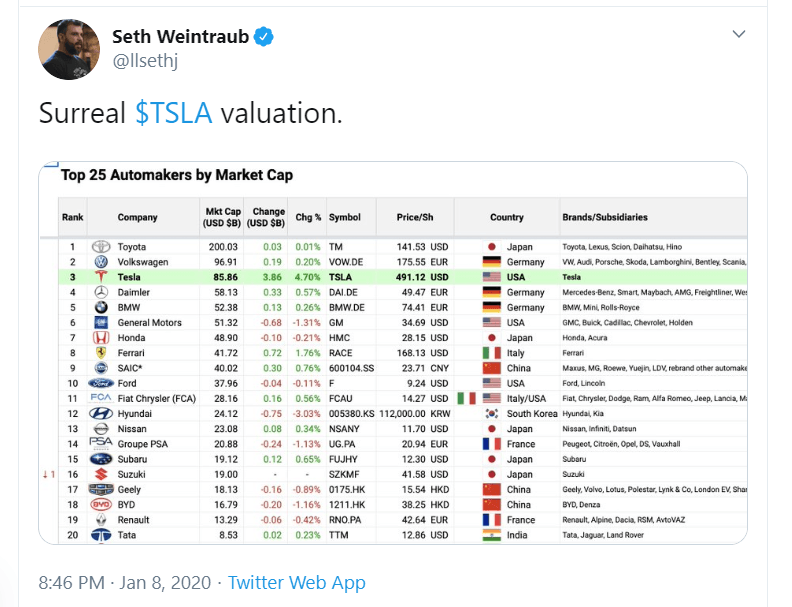

Tesla Stock Is Meaningfully Overvalued. Since becoming open in 2010 Teslas stock has increased by more than 20000. The total market cap for Tesla is 52B and 51B for GM.

You want me to say that they are overpriced. 3487 on 101822. Answer 1 of 24.

Learn the direction Fisher Investments thinks the stock market could go and plan ahead. Although Tesla has typically been more sensitive to market declines being a high multiple high growth stock it has held up better through the current volatility. 22982 on 101822.

Answer 1 of 5. Production growth EV fever and front person Elon Musk have fueled the explosive surge. Three years ago when Tesla was worth 50 billion the companys board promised Musk a huge grant of stock if he could among other things bolster the companys market.

Higher rates hurt richly valued growth stocks such as Tesla more than others because the bulk of those companies profits are expected to roll in years from. Tesla has posted its first ever annual profit capping a stellar year in which its surging share price have seen it become the worlds most valuable car maker. Just last year Tesla was short on cash.

A weakoned share price.

Even Bulls Are Selling Tesla At A 90 Billion Market Cap Nasdaq Tsla Seeking Alpha

Tesla Overvalued By 85 26 And Not A Technology Company Nasdaq Tsla Seeking Alpha

:max_bytes(150000):strip_icc()/2-fe7963f7fd8a464bbf705b505b9cc9a6.jpg)

Tesla Sell Off Intensifies Ahead Of Earnings

Wow Tesla S Share Price Rise Stuns Musk And His Fans Financial Times

Why Tesla Is A Different Trillion Dollar Company The New York Times

Tesla Stock In 5 Years Where Will Tesla Stock Be In 5 Years

Tesla Valuation More Than Nine Largest Carmakers Combined Why

Tesla Tops 2 000 A Share Is Now Worth More Than Exxonmobil Shell And Bp Combined The Motley Fool

Double Wtf Chart Of The Year Update Tesla Becomes Most Valuable Automaker Blows By Toyota Wolf Street

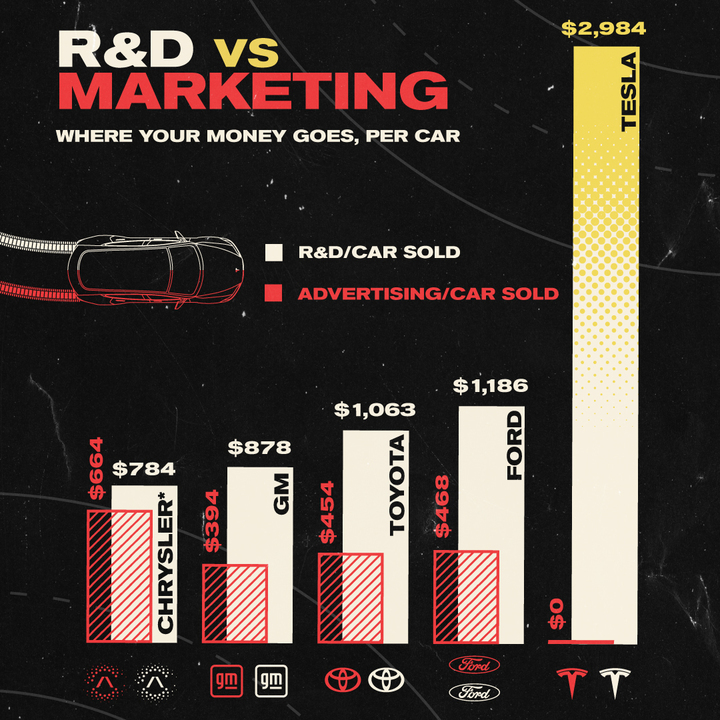

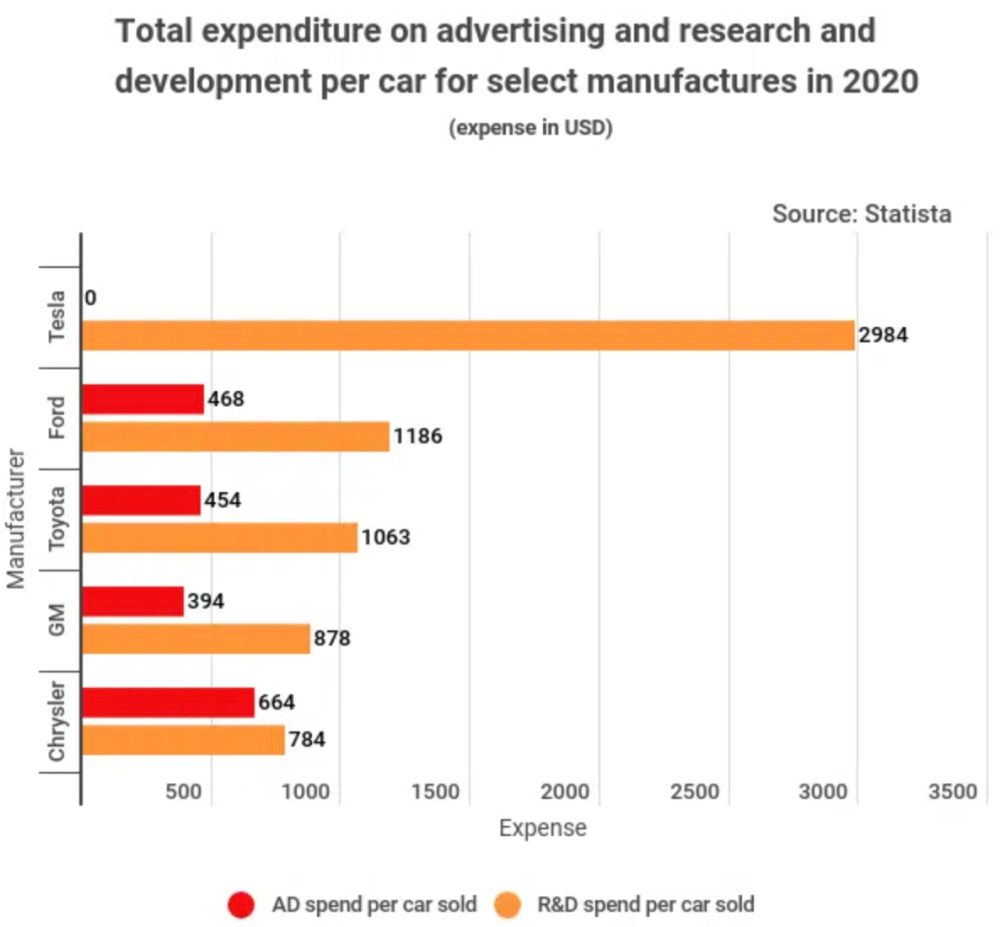

Tesla Spends The Most R D And Least In Advertising Per Car Sold Electrek

Why Tesla Is A Different Trillion Dollar Company The New York Times

Tesla Stock These 2 Charts Undermine The Tesla Bull Case Fortune

Why Tesla S Shares Are In A Bubble Right Now Nasdaq Tsla Seeking Alpha

Is Tesla Stock Overvalued The Motley Fool

Tesla Shines During The Pandemic As Other Automakers Struggle The New York Times

Tesla S Stock Market Value Tops Facebook S In Huge Trading Reuters

Why Is Tesla S Stock So Expensive Compared To Other Automakers Quora

Tesla Closes 2021 On A High Note By Besting Expectations In Q4 Techcrunch